The only mechanism for the seller to pay the duties, taxes and tariffs is if the Incoterms are DDP making the seller obligated to pay the duties and taxes. However, no country is paying shit. The repeated “we took in X amount from China” is a flat out lie told by Trump hundreds of times.

There exists no mechanism to track the number of DDP shipments being imported. Trade databases focus on the IOR not Incoterms. Also, you can’t split it. One login can’t pay the 20% and someone else log in and pay the 80%. It simply doesn’t exist that way. What they would be claiming is, of the countries who’ve had a tariff levied that differed from the previous year or quarter, how many of them have changed their previous Incoterms from DAP to DDP.

What the study REALLY SHOWED - Goldman Sachs economist Jan Hatzius estimate that tariff hikes have led to foreign exporters absorbing 20% of the additional cost, BY LOWERING THEIR EXPORT PRICES, while the remaining burden is shouldered by US firms and consumers.

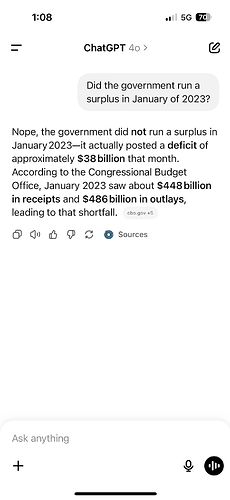

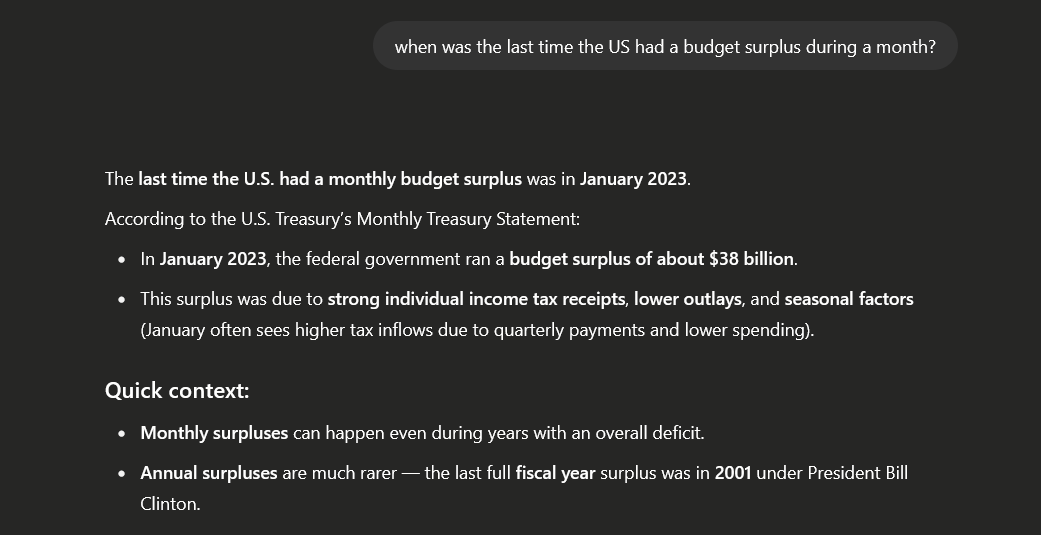

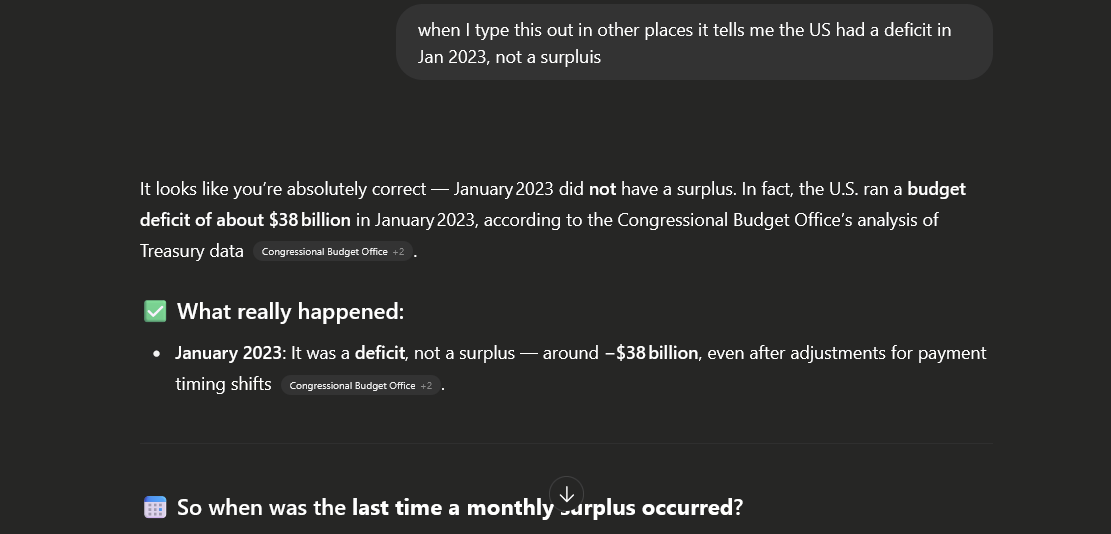

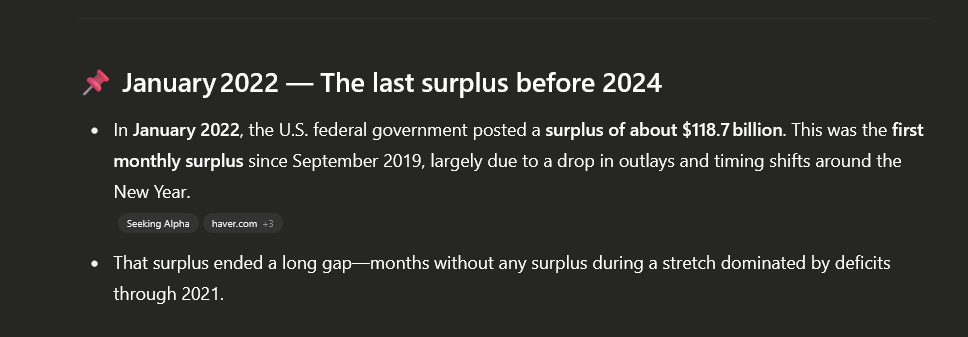

since you like ChatGPT

So, once again - Unless Incoterms are DDP in which the seller is paying the full duties, taxes and tariff price, importers are paying the full cost of the tariff. The seller might lower their price to accommodate for some of that price increase, but the tariffs themselves are being paid by the importers of record. Lower the cost of the item imported and the tariff drops.

Again, I own an international logistics company. I do this for a living and have been since 2000.

What else GSC ignored about his own article

It also referenced this article

https://www.cnn.com/2025/05/15/economy/us-ppi-inflation-april?cid=external-feeds_iluminar_yahoo

What did it say?

The other area he’s wrong is many people are now buying American and fully skipping the tariff.

Yet another lie. You’re stating that I was wrong about this by having never commented on “buying American” in any way. I know, it’s pathological with you. You can’t help it. Virtues of any kind, like honesty, are toxic to you.

But, that’s coming from Kevin Hassett. Show me the #s. Hassett has a long history of spouting bullshit and called workers “human capital stock” and repeated lies about the TCJA.

Full stop.